Product Life Cycle Management

New products and services have long been looked at by companies as an invitation for a break from crippling price pressures and razor-thin product margins [1]. However, the rapid pace of innovation has meant that the window of opportunity to capitalize on higher margins is narrowing. A Gartner study shows that product proliferation has led to a 32% increase in active items since 2010. However, the revenue growth of a mere 3-4% during the same period has meant that sales per item have dropped by 22%. The situation is further worsened when one considers the planning perspective as research shows that the forecast accuracy for new products after one year of introduction is only around 50% [2] .

CHALLENGE: MANAGING NEW PRODUCTS

SUCCESSFUL MARKET LAUNCH OF NEW PRODUCTS IS BECOMING INCREASINGLY DIFFICULT

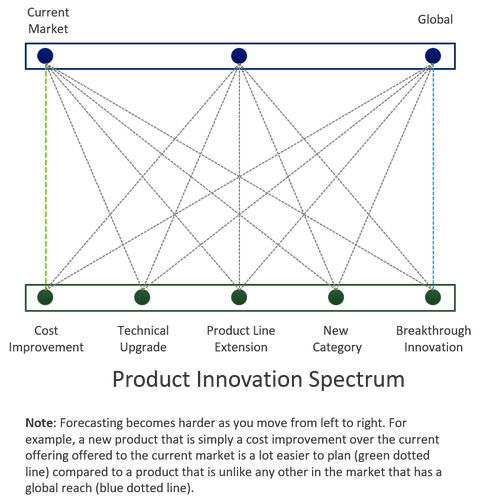

So, what makes managing new products, such a difficult problem? A new product can be an existing product for which the market foothold is expanding or a breakthrough innovation for which the entire world is a potential market and every possibility in between (visually depicted in Figure 1). As one moves from the left of the spectrum to the right, as is increasingly happening due to new innovations, successful launches become progressively difficult.

From a planning standpoint, as one moves away from the status quo, the relevance of the current points of reference drop significantly and, consequently, of historical data. As the data gets sparse, the focus needs to move beyond simply the use of quantitative techniques. The table in Figure 2 highlights the types of shift needed across dimensions of data source, technique, uncertainty or prediction intervals, scenario planning, and performance measurement.

INTRICATE QUALITATIVE DATA COLLECTION FOR FORECASTING NEW PRODUCTS

Product life cycle management and new product forecasting, as is evident from the preceding discussion, are much about entering unchartered waters and where “data does not speak loud and clear” [4]. Therefore, there is a reliance on qualitative methods that are not so much about number crunching, and if it is quantitative, it is more about considering external factors that drive demand rather than historical time series. Qualitative methods generally require significant investments in time and effort, particularly with respect to data collection. The data that is collected and relevant factors analyzed can help reduce the uncertainty and lend more credibility to predictions despite the inherent difficulty of the problem at hand.

Advanced Supply Chain Management Solutions

Modern supply chain management solutions not only support the classic procedures for product life cycle management based on historical data and statistical forecasting, but also enable the modelling and comparison of different product launch scenarios, each of which can be based on very different assumptions and prerequisites, and simulate the effects for the entire supply chain for each of these scenarios (see IBP for Demand and IBP for Sales & Operations).

[1] Ideas adapted from: Kepczynski, R., Jandhyala, R., Sankaran, G. and Dimofte, A. (2018), Integrated business planning: How to integrate planning processes, organizational structures and capabilities, and leverage SAP IBP technology, Management for Professionals, Springer, Cham.

[2] Kahn, K., 2002. An exploratory Investigation of new product forecasting practices. Journal of Product Innovation Management, 19(2), pp.133-143.

[3] Kahn, K., 2014. Solving the problems of new product forecasting. Business Horizons, 57(5), pp.607-615.

[4] Tetlock, P. and Gardner, D., 2016. Superforecasting. London: Random House.

![Figure 2: New Product Forecasting Requires a Different Focus Along Several Dimensions (Adapted from [3])](https://image.jimcdn.com/app/cms/image/transf/dimension=480x10000:format=png/path/sd52e764be952517f/image/i52c258c3660de635/version/1613662509/image.png)